I was thinking the ghost tower or cave music from R/B/Y

Also find me at @Notnotmike@beehaw.org and @NotNotMike@notnotlemmy.com

I was thinking the ghost tower or cave music from R/B/Y

Yes I think that’s the correct interpretation

Just added this to my browser this morning, coincidentally! Not sure what thread it was, but I thought it was this one. Thanks for the link though, it’ll be a big help

Thank you very much! I wasn’t aware of these guidelines so it’s interesting to read

I think the notability is a little hard to define, so I could see some discussion happening, especially about more minute details like individual items in games. But it seems like, based on the existence of a Krillin page, that there is at least some precedent for somewhat broader topics

I see what you’re saying, but also I don’t think those analogies are necessarily fair. I don’t think putting Yoshi’s birthday on Wikipedia instead of Yoshipedia is quite as critical as a central bank failure

We’re on Lemmy, which is an aggregation source just like Wikipedia. Some knowledge is only stored here, while other knowledge is an external link. It’s not a bad thing to be a central point of information as long as it is a community-driven process with high levels of transparency, like Wikipedia.

Lemmy, however, works differently from Wikipedia or Reddit in that multiple services work together to be that aggregation source, which is great, and Wikipedia doesn’t have that, which is not great. So that of course could be better in an ideal world, and I would bet there is a federated Wiki service already out there

But, I’m not talking about life changing information here, I’m talking about what happened to Krillin in episode 700 of Dragon Ball Super, I think it’s okay if that information lives in one central location - especially since you can always just watch the episode again to verify

Do you happen to know where in the rules it would list the “level of relevance”. I did a cursory read through of the content guidelines but I didn’t see anything that would necessarily exclude descriptions of specific video game content, levels, or assets, but I’m no master at Wikipedia - I can’t say I’ve contributed much beyond donations.

Also I did mention those unique features some wikis have. For example, the Old School RuneScape Wiki has some really great calculators, maps, and data collectors, so I’m very happy with those. But for less popular ones where nobody is putting in the work to make the wiki exemplary feels like we may as well save time and not give Fandom money by using Wikipedia

And look and feel I would say is good unless it’s a fandom, and then all the look and feel in the world doesn’t justify those ads

One thing that recently had me pondering was why do we need separate wikis, why not just add the information to Wikipedia? Unless your wiki has some feature Wikipedia doesn’t support, it just seems to provide a background image and ads.

For example, I was looking up some Dragonball information, and their wiki was really sparse and didn’t answer my question. So I randomly tried Wikipedia and it had all my answers

My only guess is some Wikipedia usage rules that say not to but I find that unlikely

Damn they went hard on Copilot on this release

Oh awesome! I’m looking forward to this one

White.

I think because when I was young I associated it with angels and purity and I wanted to be a good person.

Now I just think it looks crisp and clean and it’s always been “my” color in games

So I give you articles that are not only referencing the exact version of addiction you want and mention a support group that you keep referencing and you dismiss them because it’s inconvenient. I fit the references to something you might find convincing. I didn’t find sources that convinced me I found sources that might convince you.

But please, provide your own evidence, as you referenced earlier. I have provided mine, and I await yours.

You have literally said nothing at this point beyond referencing outdated version of the manual and anecdotal evidence.

Come on, now you’re just being rude and dismissive. I’m trying to come together here and come to an understanding.

I have evidence to support it

What, where? You’ve sited the DSM-V and anecdotes, the former disagrees with you and the latter is opinion

Cite one.

Here’s two:

News article using the term “addiction”:

Inside Caffeine Addicts Anonymous: ‘It Controlled Me Enough’ which also mentions a support group, like the ones you reference: Caffeine Addicts Anonymous

Scientific article using the term “addiction”:

Caffeine Intoxication and Addiction

Whether or not you agree with them, the point is that it is commonly used.

Avoiding using the word ‘addiction’ is does not make it scientifically irrelevant

No the DSM-V did that

Science says caffeine isn’t addicting

Science doesn’t use the term, it is antiquated and no longer scientifically relevant. Science says that caffeine does not cause substance use disorders.

Numerous articles still use the word addiction in them

Numerous articles define caffeine as addictive as well

Society says caffeine isn’t addicting otherwise it wouldn’t allow children to consume it

You’re so close to understanding what I’m wanting from this thread and this conversation. Caffeine is a problematic drug that we take too lightly. I do not believe we should be giving it to children, nor do I believe adults should use it frequently.

But, to your point, society does say that caffeine is addicting (we’re in a thread that is sufficient proof of that) but society agrees that the “addiction” is minor enough that it is not a big deal. I’m also sure many people would agree that sugar is addictive and yet we feed that to kids more than anyone else.

People that have had at least 2nd hand experience with actual addiction think caffeine isn’t addicting because JFC they KNOW better

The “addictiveness” of one thing being more severe does not mean a less severe substance cannot also be “addictive”. Because a gun only kills one person and nuclear warhead kills millions does not mean the gun cannot be described as lethal.

You still haven’t shown anybody who’s opinion is worth listening to that thinks caffeine is addicting

Because I don’t work in opinions, I work in science. The DSM-V says (and I can’t believe I’m stating this for a fifth time, I’ll put it in capitalized letters to make sure you see it) ADDICTION IS NOT A SCIENTIFIC TERM, so nobody will say that anything is addictive in scientific contexts because that would be a scientifically invalid statement.

Karens sitting at a brunch table playfully giggling about their lack of self control over their love for cafe mochas…

Nice, condescension and sexism. Please, I want to have a civil conversation with you about this topic, you do not need to go disparaging me or others to make your point.

You [argue]… the DSM matters…

You stated the DSM matters. You started the conversation with it.

withdrawal is not the definition of addiction

No, it is not, because “addiction” is not defined in the DSM-V besides a note about how the DSM-V does not use the term.

Religion shouldn’t be listened to

In scientific contexts, yes. Absolutely I believe that.

that everything besides your opinion doesn’t matter is a you problem.

I am quite literally citing sources that are not my opinion but are instead current scientific reality or common interpretations. My opinion just happens to agree with the science and I am not bothered by non-scientists using a non-scientific word in whatever way gets the conversation going. I am also citing the opinions of 90% of individuals in this thread - they seem to agree that caffeine is addictive.

I really want to come to an understanding between us and find some place to land.

I understand your perspective - you don’t want people to use a term that you feel has a specific definition because you feel that it trivializes your experience - and I think it’s not an unreasonable thing to want. I don’t want to trivialize those suffering from substance use disorders.

But my perspective is that people are using “addiction” as a communication tool in a non-scientific context and that there is no harm in that. It gets the point across and we are able to successfully communicate about the topic. Sidelining the conversation with corrections on terminology is really not helpful, especially when that terminology is no longer scientifically relevant.

We should be discussing the impacts of caffeine on our bodies and our society, not whether or not one word is better than the other.

I don’t know how to word this any differently, so I think this conversation is just about done.

You keep bringing up how science says caffeine isn’t “addicting” despite you yourself being the one to point out the DSM-V where they explicitly call the word out as not defined in the DSM-V. So for the fourth time: “addicting” is not a scientific term.

Just because it was preciously referenced in a 24+ year old version does not make it still scientifically relevant. It is not a scientific term any longer, and you can stop treating it like it is.

Meanwhile, in the DSM-V, caffeine is associated with withdrawal symptoms. Symptoms you yourself have described and experienced. So we can both agree caffeine use causes withdrawal.

So because (1) “addiction” is not a medical term and (2) caffeine causes withdrawal symptoms when usage is stopped it is therefore more than fair for people to define it as addicting in a nonscientific context like the one we’re in. We should reference science, sure, but science has no opinion on whether caffeine is “addicting” because, again, it’s not a scientific word.

Again, you’re arguing semantics. This is arguing “gif” vs “jif” at this point. You’ve given up on medical sources like the DSM because they don’t support you so now you are just doubling down with no basis in fact.

Hopefully, we see each other around on the Fediverse and maybe even have another discussion, but one that is more beneficial for us. This one seems to be just spinning our wheels. Good luck to you

I’ve said this three times now, but: There is no scientific definition of addiction, so you would have equal trouble finding meth described as addicting.

The post title concerns the common usage of the term, this is not a medical forum. A guy just had a question. You’re the one who, incorrectly, brought up addiction as a medical term

Okay, so why bring up the DSM if you don’t care what it says? You seem to be missing my point.

Caffeine is addicting in the colloquial sense that you want it when you don’t have it. It is not a cause of substance abuse disorder.

If Caffeine was addicting you think it is okay for children to consume it.

I never said I did and, in fact, I don’t think it’s okay. I’m an outlier in that fact and that’s my concern and the reason I’m even in this thread.

If Caffeine was addicting it would be labelled a Substance Use Disorder, it isn’t

By definition in the DSM, neither caffeine nor meth are addicting. So this is a nil point

Again, addiction means nothing here except a colloquialism. It is no longer a medical term. If you have a source for a strict definition in a scientific sense beyond the DSM I’d be happy to adjust our conversation accordingly

You cannot use an outdated version just because it fits your argument better. The nomenclature was changed, so adapt

I am respecting addicts

By calling them “addicts” you are immediately not respecting them, per the negative connotation and the superior alternative term which we’ve discussed

Trivializing the word such that caffeine counts demeans those that suffer actual addiction, and is the problem here

And sidelining a conversation about a drug to argue semantics is better? Nobody in this thread will tell you caffeine is as bad as nicotine.

My interpretation here is that you suffer from substance abuse, in the past or currently, and you feel your experience is being trivialized. If that’s the case then say that instead. Don’t argue about definitions out of the DSM, just state cleanly and kindly that you feel that “habit” is a better term and let the conversation about the topic continue. Don’t be so aggressive and self-righteous about it and people will be more inclined to listen and change.

And if you don’t suffer from substance abuse then don’t get outraged by pedantics on someone else’s behalf…

See, you’re doing it all again. The severity of one does not discount the severity of another. And “addiction” is not DSM-V defined.

Someone does not go to their doctor and says “I have a substance abuse disorder”

Rarely does anyone go to their doctor and say “I have melanoma” either, they simply tell the doctor they have a weird mole. Part of the conversation with a professional is using common phrases and nomenclature to start the dialog and work towards a proper diagnosis. I’m sure if you told a psychiatrist “I’m addicted to caffeine” they would almost certainly understand what you mean.

The line of introduction a speaker uses at those meetings is not “hi, my name is Cepho and I have a substance abuse disorder”.

I’m afraid I can’t really tell you what they say in those meetings. They are often highly religious processes and have debatable results, so I won’t be taking my clinical terminology from them.

overusage the you yourself admit too

The DSM-V admits to it, as well as the negative connotations of the word. If anything, people with substance use disorders should be inclined to avoid that word in order to prevent the negative connotations. If anything, you are actually doing them a disservice by telling us we should be calling them “addicts” when the DSM-V explicitly states that it is not a proper definition and that it has a negative bias against it.

You won’t be seeing a professional that refers to the DSM-V for it.

Not for the headache, no, but for the several other diagnoses that can arise from usage of caffeine. Stop trivializing the issue, please. Caffeine is in the DSM for a reason - it is a drug with chemical and psychological effects.

I’m not just arguing semantics.

But that’s your main sticking point, it seems. Your main issue appears to be that people shouldn’t call caffeine consumption an “addiction” - it is entirely semantics. It’s not a medical term, as we’ve said, so we may as well be arguing “gif” vs “jif” right now. It’s just nomenclature, it does not change the underlying issue of caffeine usage.

You are also arguing that caffeine is no big deal, which just seems like an oddly obtuse and head-in-the-sand take. Just because caffeine does not cause you to sell your kidney for a fix does not mean it has zero deleterious effects. Usage results in real consequences for people, even if they are relatively minor in comparison to harder substances. Having a two day headache from a beverage should not be normalized, in my opinion.

You’re clearly very passionate about this issue, but you’re arguing semantics and you are, at least from my reading of the DSM-V, not even correct.

You are against describing caffeine usage as an “addiction” because you claim it is not listed in the DSM-V as such, and yet the DSM-V clearly states that it doesn’t define “addiction” because it’s such an overused term.

Some clinicians will choose to use the word ad diction to describe more extreme presentations, but the word is omitted from the official DSM-5 substance use disorder diagnostic terminology because of its uncertain definition and its potentially negative connotation.

From page 485 of a version of the DSM-V I was able to find online.

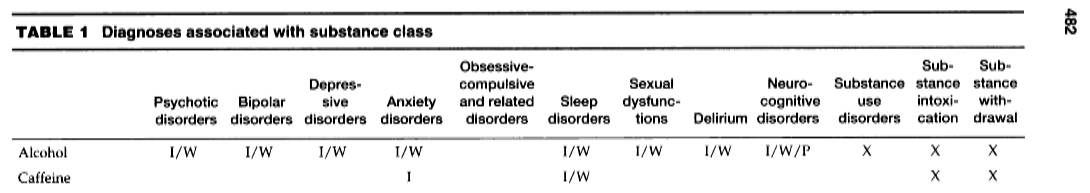

Also you claim “caffeine isn’t in the list of compounds forming addictions” in the DSM-V, and putting aside the fact that the DSM doesn’t use the term “addictions” as a diagnostic tool, the page you reference has caffeine right there near the top of the table with several serious diagnoses, although granted not substance abuse diagnoses. We shouldn’t discount a substance because one row of that table is unchecked. If it shows up, it’s there for a reason.

From page 482 of a version of the DSM-V I was able to find online.

Caffeine is associated, according to the above table from the DSM-V, with anxiety disorders, sleep disorders, substance intoxication, and substance withdrawal. You give an anecdote of how you handle the withdrawal symptoms even, yet somehow suggest that, despite having a special ceremony with dealing with a substance including taking medication, it is not a big deal just because it doesn’t have the same symptoms as nicotine withdrawal. You also hand-wave the complex biochemical reactions that make caffeine work saying a cold shower is equivalent, when it’s strictly not - a cold shower does not block any chemoreceptors unless your shower has some really wacky features mine doesn’t - and you can’t bring the DSM-V into a discussion unless you plan to talk clinically and consider the chemical pathways of the substance under scrutiny.

All that aside, you’ve correctly edited your original comment to state that you can’t get a substance abuse disorder from caffeine, and you misspoke when you said “addicted”.

You don’t get ‘addicted’ to caffeine. If you consume it daily your body will adjust to the new baselines and discontinuing will have symptoms (headache for a day, tired, etc…), but it is not a clinical addiction.

Edit: caffeine does not have a “Substance Use Disorder”, merely a “Withdrawal Syndrome” (DSM-V pg. 482)

So I don’t see why you’re still arguing with people here, nobody used the phrase “substance abuse”, they used “addiction” which is a colloquial term for excessive use of something. There’s no point to this discussion when, if you’re using the DSM-V, you should be in complete agreement with everyone.

Just let it go. According to the DSM-V, it is completely fair to call caffeine addictive in general discussion, and caffeine has real and serious effects on a persons biochemistry that you can’t just brush off because they aren’t as bad as meth.

It’s definitely got a genetic factor, but tea and a 12 oz cup of coffee aren’t excessive amounts of caffeine. The side-effects should be (hopefully) mild and mostly unnoticeable, except perhaps a day or two after quitting

Oh nice! I’ve kept the Xbox game bar running so that I can make these clips so it will be nice to ditch that bloated mess - no need for two overlays