Having had my Visa Debit card blocked twice in as many weeks, I’m beginning to question if our current “Plastic” cards are fit for purpose. A somewhat long story follows with a question at the end:

About 2 weeks ago, Skinny decided not to honour my perfectly valid Visa card. I contacted my bank to find out why my card was being rejected. They let me know that some businesses won’t take payment on cards that are approaching expiry and Skinny, apparently, won’t take payment if the card expires in the following month. The card was due to expire in 8 weeks!

I find it ridiculous to reject payments that far from expiry! What would you do if you only had access to one credit card?

I switched cards on the account and in the process the Skinny interface initiated three transactions in quick succession, of which two should not have occurred. Another long story, but it took four hours (yes 4) to sort that out. These transactions triggered my bank to block the newly registered card and warned me via text message. Thankfully, a quick reply text was all that was needed to unblock the card.

My new card arrived a week or two later (they sent it out early) - all good once I used it to make a local purchase via EFTPOS. (This card had the same card number but different CVV)

A little over a week later, I receive a text message from my bank:

We’ve blocked your Visa Debit Card due to some suspicious transactions to Google YouTube Super. If this was you, please reply AUTHORISED. If not, please give us a call on #### or pop into your local branch

These were not my transactions, so a call was made. Apparently, the card number was/had been used on multiple (21) relatively small transactions in Australia. The bank’s only option was to cancel the card and re-issue me a new one. How these transactions were being validated without the CVV (unless they had ‘cracked’ it), I don’t know. These were Google transactions, so I would expect them to have been validated?

Luckily, I was due to travel to town - a little over two hours round trip! So I went into my closest branch and received a new card (with a new card number this time). Another EFTPOS transaction at a local shop and it’s good to go again.

I’ve no doubt there are others who have had similar experiences?

I can’t remember the last time I used cash, though I always carry some. For me, a cashless society mostly works.

The discussion I had with my bank suggests that these type of blocks, due to unauthorised transactions, are on the rise significantly.

So what is the future of “money”? How can transactions be made without inconvenience, but still be secure and safe from unauthorised access?

Really just a topic starter and I felt I needed to tell the story.

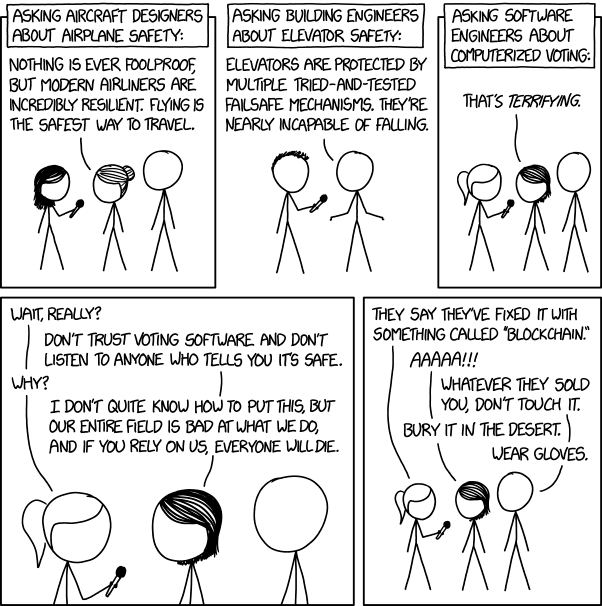

🛠️ memes aside, I’m a software developer and I don’t trust software-only systems with no fallback. Too many moving parts that can go wrong.

100% this

From what I hear in China, and possibly some other countries, if they don’t like what you do/say you’re not only censored but they’ll cut you off from your bank. Cash is king and it always will be.

Your bank account is nothing but zeros and ones. Imagine if there was a massive power outage for an extended period of time. It happened here last week, luckily for only a day, but you couldn’t get gas or groceries because there was no power. If they had power, the internet was down so the card machines wouldn’t work.

It’s easy to forget how fragile the whole system is and cash on hand will always be king.

I live in germany and never leave the house without cash because at least once a month, one of those stupid card terminals will either refuse to work properly or be blocked by my bank for no reason.

Those cards are a terrible implementation of digital money and I hope they die a swift death to make way for something that actually works.

Until then, cash it is.

A big part of the problem is we’ve handed over control of our money to Visa and other international giants. Things worked a lot better when it was all EFTPOS. But online payments and the convenience of pay wave have won out.

Unfortunately there’s no easy way back.

I’d argue the swing back to EFTPOS has already started. The greedy paywave fees have normalised surcharges, which encourage people to switch back to EFTPOS. I for one know my behavior is changing.

It’s not even about the cost. A surcharge is basically a question: would you like to make a donation to the bank and credit card companies?

One main reason that this was allowed to happen is that the implementation of online Eftpos spent too much time in the “we can’t agree” phase.

Had the banks sorted out the online Eftpos thing 10 years ago, Visa / Mastercard would have missed out in NZ. But alas no one could fully agree on the how. Now online Eftpos is only half supported.

Yeah, proper online EFTPOS is still hard to find. Instead we get Polipay crap. The idea of typing bank account login credentials into a third party website is almost as terrifying as the website scraping technology they use to process the payment.

Yep Poil is not supported by your bank. If your credentials are compromised after using Poli, you are not entitled to any compensation.

The absolute worst thing is Poli is an option when renewing your RUC mileage…WTF NZTA, that is effectively official endorsement of breaking your banks terms of service.

They aren’t the only government service using Poli and whatever the windcave version is called.

I’m certainly tending to prefer online EFTPOS where I see it. I like the process of confirming with the bank that I authorise the charge before it’s allowed to happen. I’ve struck the odd technical issue here and there with implementations, but it’s getting better.

It’s depressing how long it’s taken, though, which is basically how a system as terrible as POLi got a foot-hold.

As for paywave, I still use it sometimes at supermarket self checkouts because I figure they’re big enough to say screw you to the banks, but I don’t really use it elsewhere.

I used it through the NFC chip in my phone for a bit too, but went completely off that when ASB decided I’d have to connect it through Google Pay if I wanted to keep using it. Right now there’s no way in hell I want Google to have anything to do with knowing exactly what I’m spending money on day to day, given everything else they collect before profiling and selling the ability to manipulate me.

I’m certainly tending to prefer online EFTPOS where I see it.

I have literally never used online EFTPOS, and I don’t even recall seeing it anywhere. I’m just aware it exists, hopefully it becomes more widely available.

As for paywave, I still use it sometimes at supermarket self checkouts because I figure they’re big enough to say screw you to the banks, but I don’t really use it elsewhere.

I tend to use paywave when there is no surcharge. Places like supermarket chains will for sure be negotiating to get the best deal for themselves, and I wouldn’t be surprised if this is near the break even point for the banks/credit card companies. Because who is gonna want a Visa card if you can’t even use it at major supermarkets?

But for smaller places, surcharges are so common that I assume if you don’t have one (but you do have paywave) then you probably took the one fee deal from the provider and get charged the same whether someone uses paywave or not. If it’s a little mum & dad shop I’ve always tended to use EFTPOS over credit because I know the credit fees are high, and getting 1% back as a reward doesn’t really matter to me when I’m only spending $20.

I used it through the NFC chip in my phone for a bit too, but went completely off that when ASB decided I’d have to connect it through Google Pay if I wanted to keep using it. Right now there’s no way in hell I want Google to have anything to do with knowing exactly what I’m spending money on day to day, given everything else they collect before profiling and selling the ability to manipulate me.

A bit like you, I started using it and telling everyone else about it and helping them set it up, then did a hard stop when Google Pay got involved. Like you, I don’t want Google collecting even more data on me than what they have by having their analytics tool on the majority of sites on the internet (ok, I admit it, they don’t actually get that data from me because of ad blocker + DNS sinkhole but I still don’t want them getting my payment data).

I have literally never used online EFTPOS, and I don’t even recall seeing it anywhere. I’m just aware it exists, hopefully it becomes more widely available.

It might just be a coincidence of the retailers I frequent, but every so often I come across a new one. Maybe it’s getting more enticing with more banks signing up, plus a third party payment provider or two.

Mighty Ape was an early adopter and I found something cheap to buy there just so I could test it out. Ascent and PBTech are where I tend to order most of my geek stuff from lately and they both support it. At least one of the pizza chains (Dominoes?) supports it for payment in their app.

I’ve hit a couple of early snags, though. When Ascent first implemented it, it didn’t accept my payment because it didn’t like me having a 0 at the front of my phone number. I guess they were converting it to an integer for some reason and didn’t think of that. They fixed it when I reported it.

Also a couple of times with ordering a pizza I’ve found the company never got confirmation that I’d paid. In that implementation it relies on me switching back to the app before a timeout, so the auto process can complete, but it has to be after I’ve been to my bank app to confirm the payment. I’ve been caught out by this at least twice because I didn’t realise the order hadn’t gone through for ages, then had to order and pay again, then had to wait ages to get the refund for the first one. Consequently several times I’ve gone back to credit cards for the few delivery pizza orders I put in. I figure they intentionally obscure the prices so much that I don’t really care if they have to absorb an extra fee. I’d still rather use online EFTPOS if I felt I could trust it with them, though.

Interesting! I buy from PB Tech and Mighty Ape on occasion, I must just not have noticed the option as I’d already have saved payment details.

It’s interesting if you don’t return to the site the money transfers but not the order. It seems like a failed design, it must happen all the time.

Yes I hope that’s purely an issue with their app’s implementation, rather than something broken with online EFTPOS’s flow generally. I’ve never struck a similar problem with other retailers, although for others I’m usually buying through a browser on a desktop system rather than a smartphone app, so you don’t get quite the same requirement of completely switching away from it to approve the payment in your banking app.

2FA would probably be part of the answer: whereby you get a text / app notification with a unique code to confirm a transaction. Not always convenient, I pretty much always sigh when having to use them, but at least significantly harder for people to spoof.

I can imagine a future, not that far off, where physical cards are obsolete, and phones are the primary identifying factor in everyday transactions.

But yeah that whole not honoring transactions from a near(ish) to expiry card thing is total BS. I’d be looking to ditch Skinny if that happened to me.

I had to do a 2fa over a $5 transaction the other day, I was a bit annoyed.

I think Two-Factor Authentication is already part of the solution i.e. there are some transactions I do now that require a code sent by text as part of the transaction, but it can’t be the full solution yet. Why, because there are still plenty of people who don’t have mobile phones (many in other parts of the world). In its current form it’s certainly not convenient for day to day purchases etc.

Skinny is good value, not considering leaving them, but the expiry thing is crap. I’ve not experienced it with anyone else (oh, their online chat system sucks too, especially if you get kicked off and have to start the process all over again).

I was with Robobank a while back and they had a little dongle (Digipass) that generated access/security codes, i.e. 2FA, on all transactions. It was f’ing awful to use and was the reason I left.

What was wrong with it?

I should confess that there were other reasons I left as well e.g. lowing interest rates, poor communications. Also note that with the account I had at the time, there were not “Plastic” cards that came with the account - this was an online only transaction account.

The Digipass dongle felt like it was designed for a child, very small with small buttons, which had very poor tacktile response, leading to lots of missed numbers and having to go back and re-enter. Having to dig it out every time you wanted to move money between accounts or out of accounts. Entering codes for EVERY transaction. Secure yes, convenient no.

There in lies the problem - the balance between security and convenience I guess?

I’ve envisioned a device that just displays the name of the merchant and the transaction amount, and all you have to do is push “yes” or “no”.

What you’re describing seems like a…not very good way to realize that vision.

But yeah that whole not honoring transactions from a near(ish) to expiry card thing is total BS. I’d be looking to ditch Skinny if that happened to me.

I’m trying to think through the logic of it. You’d think a card would be good up to expiry. Is it that banks send out new cards when expiry is approaching, people throw the old one in the bin, and people find them and use them in the short time before expiry?

If the bank can activate the replacement card when it’s first used locally, why can’t they inactivate the old card at the same time?

Normally these sorts of rules only exist because the company has had a problem in the past, but it does seem a bit odd to me.

If the bank can activate the replacement card when it’s first used locally, why can’t they inactivate the old card at the same time?

I was under the impression that’s exactly what they do?

Then why do skinny not accept cards up to expiry?

You have to give them the number all over again because the expiry date is different.

The OP’s problem is that Skinny wouldn’t accept a card that was close to expiry, even though they didn’t have a replacement card yet. I’m curious as to why that would be a policy.

People who get billed at month end but the card is no longer valid and they don’t update so there’s no way to get then to pay excerpt trying the collections route.

Or, just make try to ensure any card used will be billable at month end.

It’s a bit stupidly implimented, because of the way it fails to align with how banks do things. IMO it’d be better applied only to new accounts.

Ah I see, that does make sense if the card is being entered to cover a future transaction.

I’ve only ever done prepay my whole life so I didn’t think of post pay customers.

You are lucky the bank is catching these unauthorised transactions and not holding you responsible for them.

I have never had the problems you describe.

I think for the Skinny related issue, that’s their fuckup, not the bank’s.

Cashless society, very bad idea. It wouldn’t function and I think the top level knows that.

I don’t see any change to using cash, every store and most places except public transport accept cash.

We will continue to see developments on the digital side, ie wristbands and chips for contactless payment.

Perhaps in another generation when we have had cashless for so long it becomes less common, but so much of the lower class depends on physical cash, that unless the banks issue physical devices to stand in for cellphones and mark-of-the-beast implanted chips, cash will remain.

I don’t know any parent who doesn’t want cash to remain a thing. They need to be able to give their kid cash to go buy lollies at the dairy, or for their tooth etc.

I think that this was just a shit situation caused by skinny and that digital and cash will continue to function without major issue.

I only read all this because it happened to me recently when I got gas out of state. It happens to people. People get diseases when you don’t either. Telling them you’re healthy won’t help.

Amen brother 🙏

I went through a round of this with my bank a couple of years ago. They would reissue a card that would be compromised in days and the cycle would go around. It was an internal security problem for them that eventually got sorted out. I remember one card was cloned and bought several dozen monthly transit passes in Boston (contactless purchase) before it was caught. I live in Western Canada. So yes I carry cash. A lot of younger retailers don’t even accept it. They just have that square tap system tied to their phones.

Cashless requires an effective cash substitute, otherwise people who can’t get bank accounts are not able to use money.

These people include but are not limited to:

- newly adult children of “off grid” or religious cult parents who did not register their birth, or whose parents are withholding their vital documents

- people who have lost all their identification in a disruptive life event such as a house fire, flight from a war zone, unexpected incarceration with subsequent loss of home and belongings, or due to activity resulting from untreated mental health conditions

- identity theft victims whose electronic reputation has been destroyed

- victims of bureaucratic error who are officially dead or otherwise tangled in red tape

- immigrants, migrants, and refugees who are not “legal” and who therefore can’t get the documentation they need (regardless what you think of those who skirt immigration laws, this group includes people brought into a country as children, and human trafficking victims and even if it didn’t the punishment for illegal immigration should be deportation, not starving on the streets)

Outside of that, while a cash or cash equivalent economy allows for various criminal and black market economy, it also provides a buffer for targeted minorities or other potential victims if there’s an outbreak of fascist and/or genocidal government.

This is the bulk of why I think we need some form of legal currency that is bearer only.

15 years ago or so, I worked for a bank that made their cards not work at Walmart due to the high rate of fraud there.

When a customer called it, the solution was to tell them this and ask them to use a different card or an atm for cash.

If they only had one card, they were out of luck.

I can’t remember, but they might have been able run the card as debit and use their pin.

Either way, cashless is not a good society.

I see a lot of comments that a cashless society would not be a good one, but no reasons behind this.

Sure, current implementations and technology make it nonviable, but I cannot think of any reason why this could not change in the future.

Hypothetically, the government’s central bank could issue a crypto-based currency, backed by them, and equal exactly to the dollar. Let’s call it the Kiwicoin. This coin would work using an official wallet, and perhaps other 3rd party wallets. It could be used with a debit-card, like some places already have (crypto.com, wirex, etc). You could exchange fist into this, and back, 1:1 with no fees. Instant transactions, resilient network, complete record of transactions. There are many potential benefits.

This is only one option, I’m sure there are other ways of executing a cashless society. Cash has no intrinsic value, and other than being a physical object, has no benefit over the numbers in your bank, and several downsides.

I’m with you on this. None of the things people are worried about are inherently unsolvable, they just haven’t been solved yet.

Some shops are already cashless, and over time I expect this to grow. I don’t think the government will suddenly decide to stop making cash, but rather over the next few decades I think the number of shops not taking cash will increase until it becomes the majority. There will be a critical point where enough shops don’t take cash that people stop carrying cash, then the remaining shops taking cash will probably see a significant drop in the number of people using cash until no one bothers accepting it.

Also, I seem to recall a paper-based EFTPOS being used in the past when I’ve been to a supermarket when the EFTPOS network was down. It’s been a long time since I’ve seen a supermarket with EFTPOS down though.

One simple solution may be to revert back to the old way of doing things. Not cash, but those zip zap credit card machines that shops used to have.

I called them ‘shick shack’ machines. 😂

What are folks in places like Gisborne supposed to do when the infrastructure for digital payments goes out in another flood?

I tend to have all the weird problems but in decades of using cards I don’t think my troubles combined are anything as bad as this.

This isn’t a common scenario.

Monero, it’s the only digital currency that resembles cash.

Cryptocurrency, in all its flavours and colours, is a scam. Don’t buy into that bullshit.

This is a blanket statement that simply isn’t true.

Most crypto is a scam, for sure, but the technology is sound and could easily be implemented for everyday life.

Unless you look at that pesky evidence

And what evidence is there that all Crypto currencies are a scam?

And for the record, I am not a crypto bro. I don’t hold any crypto, and have no interest in doing so.

Maybe it theoretically could, but it won’t, because it’s a scam and its entire purpose is to be a scam. That’s why cryptocurrency was invented: to separate people from their actual money.

It most definitely was not invented to “separate people from their actual money”, and since the original white paper’s author is unknown, you absolutely cannot back up that statement.

Many crypto currencies have been made more accurately as pyramid schemes, definitely. But nothing about the technology requires this, Bitcoin and many of the largest, most stable currencies absolutely weren’t invented as pyramid schemes, and there is nothing stopping a government from using the technology to created a fiat currency.

Not useful to make everyday purchases is it?