- cross-posted to:

- technology@beehaw.org

- cross-posted to:

- technology@beehaw.org

I know this is more business than tech related, but for some reason I am not able to post it to the business community, so I’m posting it here.

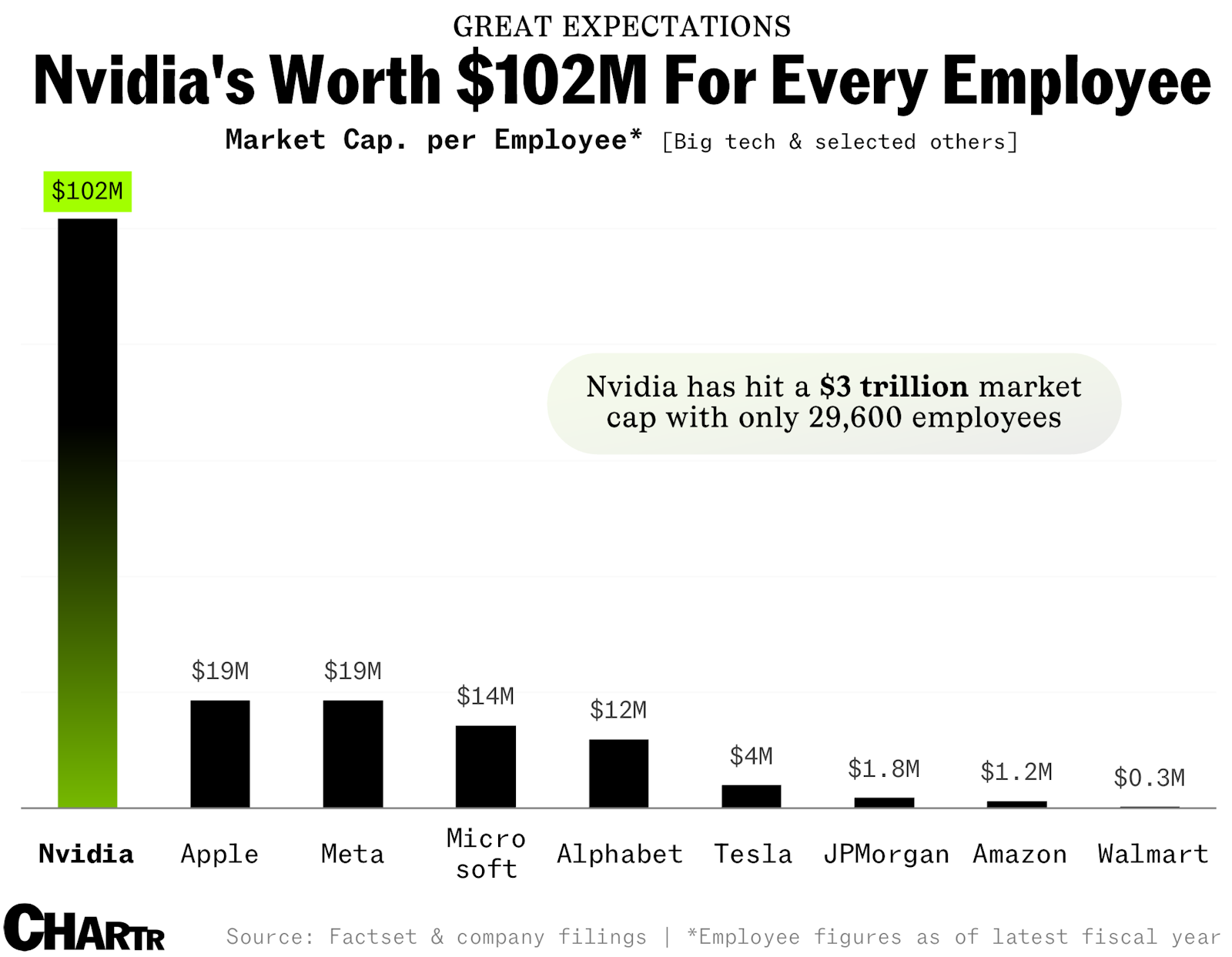

"…For Nvidia, after this latest run-up took it north of the $3T milestone, the company is being valued at more than $100M for each of its 29,600 employees (per its filing that counted up to the end of Jan 2024).

That’s more than 5x any of its big tech peers, and hundreds of times higher than more labor-intensive companies like Walmart and Amazon. It is worth noting that Nvidia has very likely done some hiring since the end of January — I think the company might be in growth mode — but even if the HR department has been working non-stop, Nvidia will still be a major outlier on this simple measure.

We are running out of ways to describe Nvidia’s recent run… but a nine-figure valuation per employee is a new one."

Book value doesn’t take into account future value, wall street value does

Meaning speculation. Just because someone is willing to buy Nvidia stock at a $3 trillion valuation doesn’t mean it will someday achieve that kind of tangible value.

The problem is believing in some kind of objective, “tangible” value.

You don’t have to believe in objective tangible value. However, there’s clearly a difference between a vegetable farm and a cryptocurrency. The former makes something and provides services. The latter does not. These are extreme examples of market and value distortion. The very existence of crypto is a nail in the coffin of the neoliberal theory about rational markets.

What’s the difference, really?

The market ultimately dictates value

Cool. I am glad to know I imagined the real estate crash of 2007.

Ish, over the medium to long term Nvidia will have to start paying dividends that align with the cost of the share. Otherwise the market will leave for better paying, lower cost stocks.